by admin | Sep 25, 2018 | Accounting News

Ministers Humphreys and Breen publish third B&A survey on Irish SMEs views on Brexit from Department of Business, Enterprise and Innovation Ministers Humphreys and Breen welcome increase in numbers of businesses preparing for Brexit and urge others to start...

by admin | Sep 17, 2018 | Accounting News

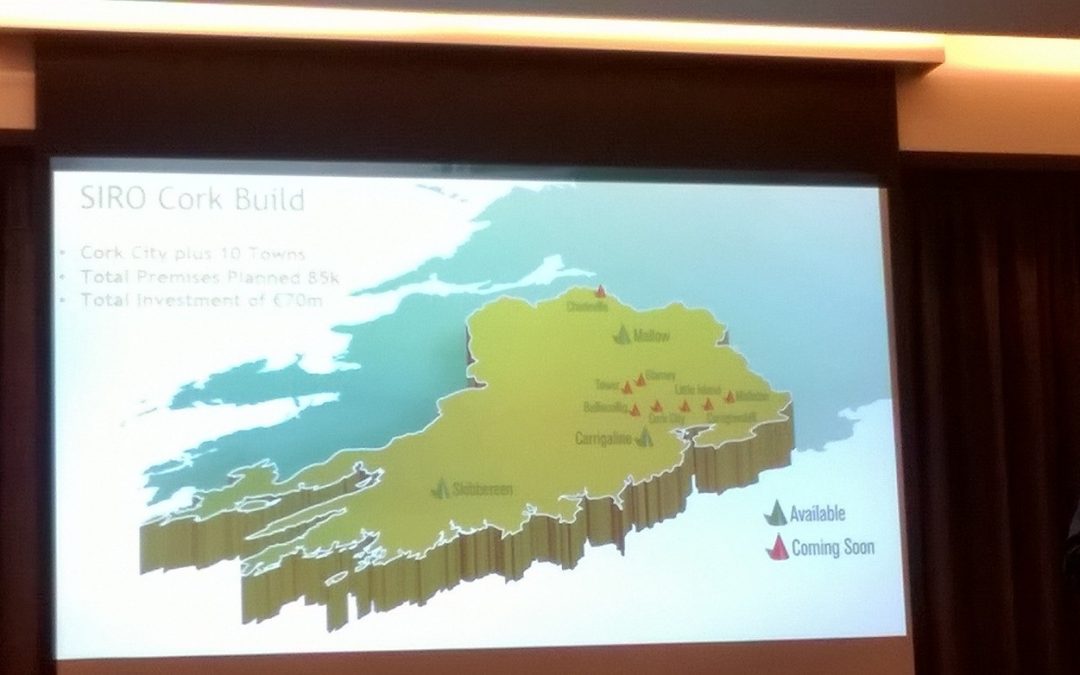

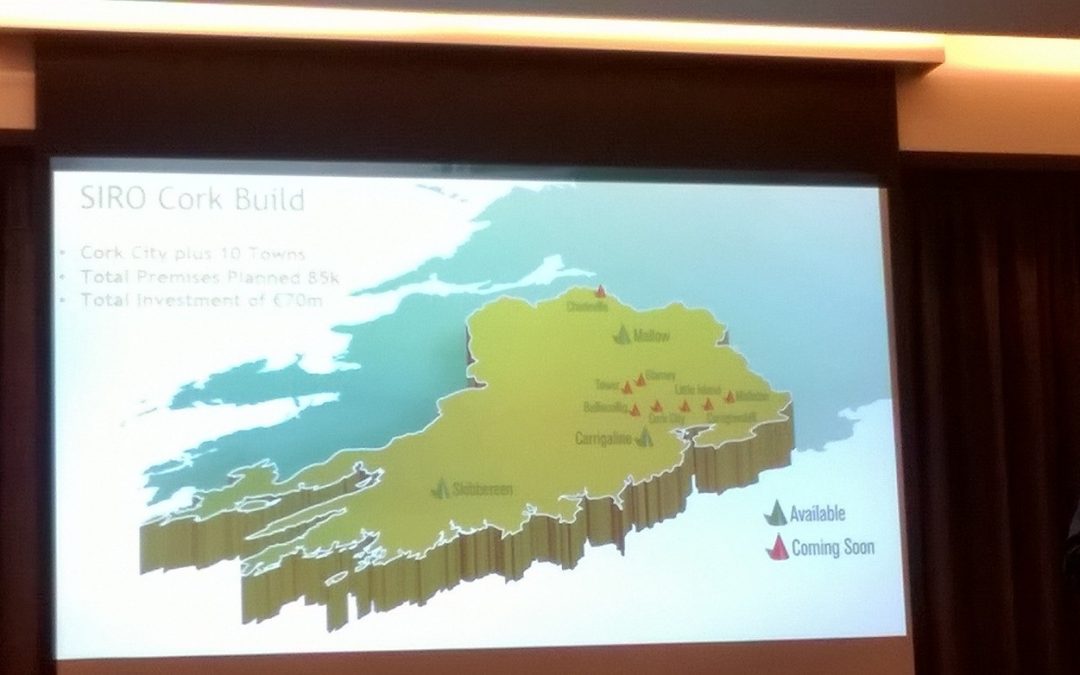

Murray Cloney & Associates Limited is delighted to announce and greatly welcomes the proposed roll out of SIRO’s €60 million fibre broadband project to several cork towns, which we are delighted to say, includes our own Charleville. We were pleased to attend the...

by admin | Sep 10, 2018 | Accounting News

Jeremy Cape and Dickie Chan of Squire Patton Boggs discuss the proposed VAT rules which will apply if the UK leaves the EU on 29 March 2019, without a deal on trade or other laws and regulations. HMRC has published guidance entitled VAT for businesses if there’s no...

by admin | Jun 15, 2018 | Accounting News

Very Interesting article in the Independent.ie re what may or may not be haooening to your private emails…did I say ‘private’..is there such a thing online now?...

by admin | May 24, 2018 | Accounting News

Privacy Policy/Protecting Your Data. Protecting your personal and company data through a strong privacy policy has always been a key focus for all of us in Murray Cloney & associated Ltd. As a professional accounting services provider, we have therefore been aware...

by admin | May 17, 2018 | Accounting News

MCAL were delighted to attend today’s Intertrade Ireland’s ‘Practical Help to Navigate Brexit’ event, held in the brand new event centre in Pairc Ui Choimh. Chaired by RTE’s George Lee, the panel included Dr Vincent Power, A&L Goodbody, Moira Creedon, Artemis...

Recent Comments